2024 Key Financial Data

As we step into the new year, 2024 brings forth several noteworthy changes in the financial landscape that may impact your wealth management strategy. In this blog post, we’ll guide you through key updates on tax bracket thresholds, Medicare premiums, and qualified account contributions, ensuring you stay well-informed and prepared.

Tax Bracket Thresholds:

Understanding the changes in tax bracket thresholds is crucial for effective financial planning. In 2024, the following adjustments have been made:

Married, Filing Jointly

-

- Top of 12%: $89,450 to $94,300

- Top of 22%: $190,750 to $201,050

- Top of 24%: $364,200 to $383,900

Single

-

-

- Top of 12%: $44,725 to $47,150

- Top of 22%: $95,375 to $100,525

- Top of 24%: $182,100 to $191,950

-

These adjustments aim to align the tax brackets with our current environment based upon inflation. It’s essential to reassess your income and tax strategy in light of these changes.

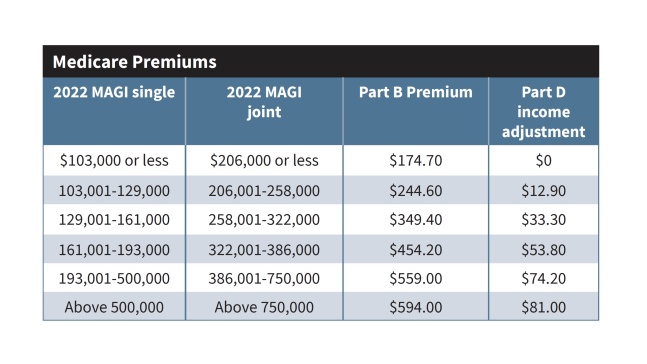

Medicare Premiums:

For those enrolled in Medicare, it’s important to be aware of the adjustments in premiums for 2024. The new premium is as follows:

-

- Part B Premium: $164.90 to $174.70

Additionally, Medicare Parts B and D premiums can be impacted by Modified Adjusted Gross Income (MAGI). Amounts are monthly per person. Part D adjustments are in addition to the drug plan premium. The premium adjustments are based upon the prior prior year tax return. For 2024, the 2022 MAGI will be assessed to determine Medicare premium surcharges.

Understanding these changes is crucial for managing your healthcare costs effectively. We recommend reviewing your current coverage and considering any necessary adjustments to align with these new premiums.

Qualified Account Contributions:

Contributing to qualified accounts is a cornerstone of many wealth management strategies. In 2024, there have been updates to contribution limits for various accounts:

Before Age 50

-

- 401(k): $22,500 to $23,000

- IRA (Traditional and Roth): $6,500 to $7,000

After Age 50

-

- 401(k): $30,000 to $33,500

- IRA (Traditional and Roth): $7,500 to $8,000

These changes present opportunities to optimize your retirement savings and tax benefits. Ensure you take advantage of these updated limits to strengthen your financial position.

Key Financial Data for 2024:

For your convenience, we’ve compiled a document outlining all the key financial data for 2024. This includes detailed information on tax brackets, Medicare premiums, and qualified account contributions. You can access the document here.

As always, we recommend consulting with your Great Waters Financial team to tailor these updates to your specific financial situation. We can provide personalized insights and strategies based on these changes.

In conclusion, staying informed about financial changes is vital for making informed decisions. We’re here to support you in navigating these updates and ensuring your financial plan remains robust in the face of evolving circumstances.

If you have any questions or would like to discuss how these changes may impact your unique financial situation, please don’t hesitate to reach out to our team.

Wishing you financial prosperity in 2024!

Have a Question?

Do you have specific questions about your next life phase? How can we help?