What makes a retirement plan succeed? What makes a plan fail?

Retirement opens the door to rediscovery. From hobbies to passions old and new, explore how to create purpose, joy, and connection in this exciting next chapter of life.

Discover common myths that many people believe about retirement.

Don’t let Social Security myths derail your retirement. Learn the truth behind five common misconceptions and gain confidence in your financial future.

Navigating the retirement of your financial advisor can be overwhelming, especially when working with someone who runs a one-person operation.

At Great Waters Financial, we pride ourselves on breaking away from the sameness, offering a unique approach to financial planning that empowers our clients to Live Greatly™

Ultimately, naming your values later in life is about creating clarity and focus, allowing you to make the most of your retirement years.

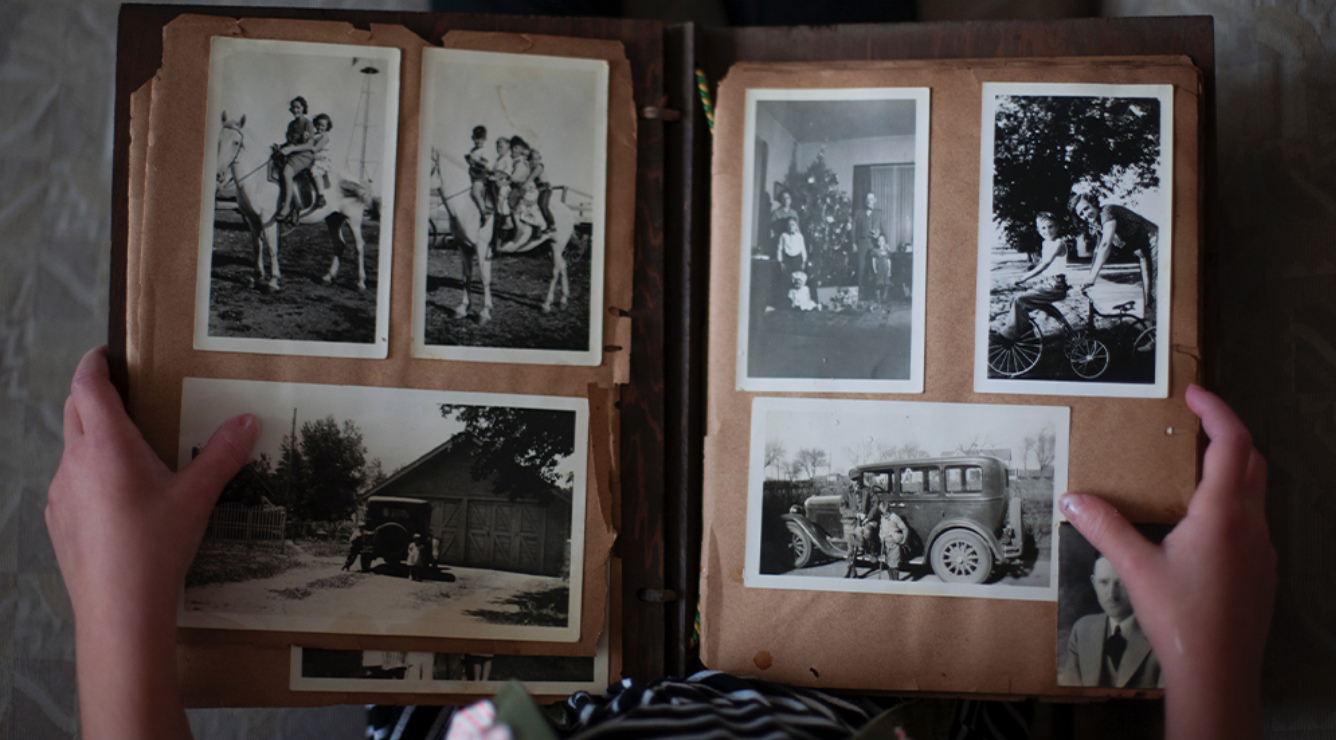

Embracing your story—by reflecting, connecting, and planning—empowers you to live with clarity and purpose.

Financial clarity is essential for a stress-free and fulfilling retirement. Your Clarity Framework exists to guide you along this path.

2024 brings forth several noteworthy changes in the financial landscape that may impact your wealth management strategy.

We are committed to helping you protect your financial assets. In this article, we will explore why identity theft is a growing risk and provide you with proactive steps you can take to defend against it.

There seems to be a direct correlation between retirement and the “end” of something. But what about the beginning of something new?

Wondering how to measure the success of your investments? Here are some key questions to ask your financial advisor.

There seems to be a direct correlation between retirement and the “end” of something. But what about the beginning of something new?

When thinking about the idea of entering retirement, many people experience a combination of emotions – some excitement, but also some fear.

While it’s fair to be irritated or concerned about this present reality, there is an opportunity to reframe the situation by asking a few key questions.

There seems to be a direct correlation between retirement and the “end” of something. But what about the beginning of something new?

COVID-19 put a crimp in all of our short-term plans. But why should it change our long-term goal of being able to retire (or not) as we’ve always dreamed?

No one could have predicted how the 11-year bull market would end: a global stock market sell-off caused by a virus and an argument between Russia and Saudi Ara.

We’re living in uncertain and rapidly changing times, that’s true.

If you’re one of the millions of pre-retirees who is heading solo into retirement, you’re definitely not alone.

If you’re a homeowner looking ahead to retirement, you’re probably hearing a lot about downsizing these days. And depending on your local real estate market, the decision may even feel more urgent.

It’s one of the most commonly asked questions we hear from people nearing retirement age. When nearly half of Americans don’t feel confident they’ll have enough saved for retirement*, it’s no wonder pre-retirees are wondering if they’ll have enough to live on.

The start of 2020 ushered in a new federal law that affects your retirement savings and retirement planning.

Do you know that old saying, “don’t put all your eggs in one basket”? It’s the same when it comes to investing.

After working with thousands of people, we discovered that too many people limit themselves by over-focusing on the numbers.

With the New Year comes new regulations from the IRS, which may impact your retirement plan, and the age at which you retire.

In order to get clarity on how much you need for retirement, you’ll first want to consider these 3 questions that can help you answer that question.

Chances are you and your partner might be thinking differently about retirement.

The charitable contribution tax deduction is a powerful way to fund your favorite charity and receive a tax break.

The decision of how and when to take Social Security is a much bigger decision than most people realize.

There’s a lot of talk in the news that the Social Security trust fund is set to deplete in 2035.

Yes, it is. On average, Social Security beneficiaries receive between $500,000-$1,000,000 in benefits.

There are few things more despised in the financial world than a budget.

When it comes to understanding when you can retire, there are a variety of questions to consider before determining the date.

There are a number of factors that need to be considered when considering the best way to pay off debt.

As the new year is well underway, it is worth acknowledging that there is no cure-all for restoring losses. However, not all is lost.

With a new administration in the White House, there are a couple of key points that could change the landscape of retirement.

There is more to self-care than meditating or creating “me time”. Our physical health is connected to our financial health!

There are a lot of moving pieces to taking money out of your accounts. We broke things down to help you navigate the process.

Paying for medical expenses in retirement continues to be a top concern for Americans. Are there ways to maximize the benefits you receive from your employer?

The Covid-19 pandemic has taught us to expect the unexpected, and that planning for anything can be tough. But one thing you can plan for is open enrollment.

It is often said that the two top priorities in a person’s life are their health, followed by their finances.

You may be familiar with risk tolerance, however using tolerance as the only measurement of risk may actually be a disservice to you.

The idea of legacy planning goes far beyond documents and account values. How are you going to pass on your legacy?

There are hundreds of articles on how to increase your income in retirement, But what about making the most of things that are beyond money?

When the market drops, it’s important to not lose perspective and understand that downtrends and uptrends are part of the investing cycle.

Money can’t buy love, but it can sure put an end to it!

Money can make people do crazy things. Here is how your estate plan could effect the relationships in your family.

An estate plan helps direct your assets upon your death, but it also plays an important role while you’re still alive.

Developing a cost assessment will give you insight into what it might look like to have to pay for care.

If you find yourself in the majority that needs this type of care at some point in your life, how will it look?

With the suspension of student loan payments coming to an end, it’s not just millennials preparing to see an increase to their monthly expenses.

For a lot of people, one of the unspoken reasons they hold off on retiring relates to their fear of being lonely. Here are some tips to become more connected.

Budgeting, social security, and risk management are three key areas to review as you prepare for retirement, but that is just the tip of the iceberg.